A Guide to Choosing an Auditor

Our clients often look to us for guidance when they are in need of a comprehensive audit or financial review. Depending on your organization’s needs, we can help you choose a CPA (certified public accountant) firm that will deliver the most value for your time and money.

There are several reasons to seek out independent verification of your financial statements. Perhaps you are considering a business move – either selling your business or acquiring another. Or maybe you are applying for a business loan, and your bank lender requires an audit before approving the loan. Alternatively, if you manage a nonprofit organization, you know that individual funders and/or state and local governments sometimes require an audit.

As anyone who has undergone an audit knows, it can be an expensive and time-consuming endeavor. But, depending on the goals for the financial review, a formal audit may not be necessary. Some funders and banks may be willing to accept compiled or reviewed financial statements rather than a full-blown audit.

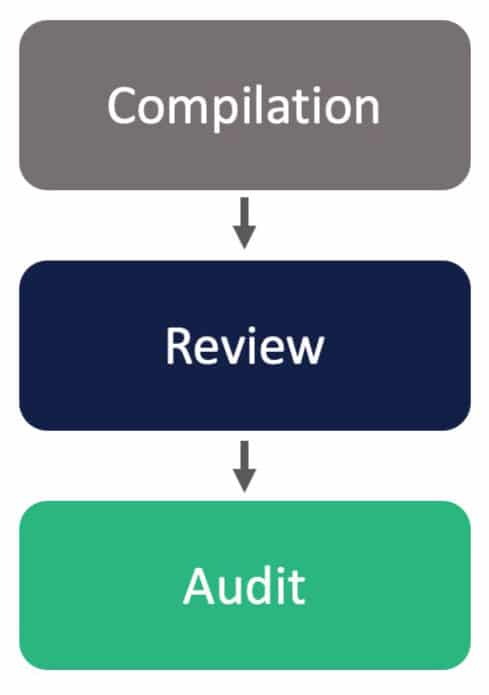

The following are three levels of financial review we will explore:

A basic presentation of your company’s financial statements drafted by a CPA using the financial data furnished by your organization. Unlike a review or an audit, a compilation provides no assurance of the validity of the financials because the CPA is simply summarizing the financial information he or she was given. With a compilation, the CPA does not review your internal controls or perform tests on the data or compare the data to any financial expectations. Therefore, they cannot provide an opinion or assurance that the summary is accurate.

Note that a CPA who performs a compilation is not required to be independent of your business so you may enlist a CPA affiliated with your organization to conduct a compilation.

A limited evaluation of financial statements which is performed by a CPA to provide limited assurance on financial statements. Because a review is narrower in scope than an audit, it can save you money and time.

Following an analysis of your financial statements, procedures, and management, the CPA will indicate if they are aware of any material misstatement of the organization’s financials.

An external audit includes an in-depth analysis of your organization’s financial statements and internal controls. Audits are performed by a CPA firm and result in an audit report that includes the auditor’s opinion on the financials. A “clean” opinion means the auditor is reasonably assured that the financial statements are accurate and consistent with Generally Accepted Accounting Principles (GAAP). It is important to note that absolute assurance is not feasible for an audit.

To give you an idea of how daunting it can be to choose an audit firm, as of late 2022, there are more than 1,000 actively licensed CPA firms in Connecticut. Not all of these provide audit services.

Depending on the goal of your audit, here are some things to consider when comparing audit firms:

Over the last 35 years, we have worked with some of the most highly respected CPA firms in New England. If you are looking for a compilation, review, or audit of your organization’s financials, our experienced professionals will ask questions to understand your goals so we can recommend firms that will best suit your needs. And, if you have a firm in mind, we are happy to review any requests for proposals (RFPs) you receive and provide our feedback.

In the meantime, if you would like to explore if ARI is the right outsourced accounting partner for your organization, contact us today.