Demystifying Asset Classifications for Non-Profit Organizations

Many of our non-profit clients and their Board members often express confusion about the requirements for classifying net assets.

The net assets for a non-profit organization are similar to retained earnings for a for-profit company – they represent the cumulative earnings of the company from inception to date. The major difference is that, in a non-profit entity, the net assets are split into three categories, which are described below. Like a for-profit, net asset classifications appear in the equity section of the Statement of Financial Position (SOP).

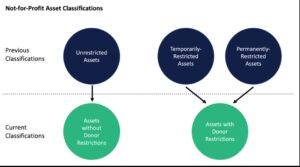

Until recently non-profit organizations classified net assets into three categories:

In 2018, the Financial Accounting Standards Board (FASB) replaced these three net asset classifications with the following two:

It is important to note that many non-profit organizations continue to use three net asset classifications in their internal financial statements. The current two classifications shown above are used for GAAP (Generally Accepted Accounting Principles).

Similar to the Balance Sheet in the for-profit world, the SOP gives readers, including members of the Board of Directors and Finance Board, a clear picture of the breakdown of net assets to help them understand the overall health of the organization.

For a quick health check, readers should compare the organization’s cash and cash equivalents (cash, receivables and investments) to the amount of restricted net assets, both temporary and permanent. If the total cash is less than the restricted assets, the entity is considered to be “under water.” A non-profit entity with little cash and cash equivalents and a lot of restricted assets is never a good thing.

In addition, as part of the annual audit process, auditors will validate asset classifications to ensure the organization has properly recorded all restricted contributions. They will also review all releases from restrictions to ensure the organization is spending funds appropriately.

If you are considering outsourcing your organization’s accounting requirements, you’ve come to the right firm. We have decades of experience in the non-profit accounting space and have worked with scores of organizations.

Discover the 10 Benefits of Outsourcing Your Accounting Function and contact us to discuss your needs and determine if we are the right fit for you.

In the meantime, check out a list of all accounting tasks we manage so you can focus more time on your non-profit’s core mission.

In 2018, the Financial Accounting Standards Board (FASB) identified two classifications for net assets: 1) Net assets with donor restrictions and 2) Net assets without donor restrictions.

It is important to note that many non-profit organizations continue to use three net asset classifications (unrestricted assets, temporarily-restricted assets and permanently-restricted assets) in their internal financial statements. The current two classifications for net assets are used when adherence to GAAP (Generally Accepted Accounting Principles) is important.

Similar to the Balance Sheet in for-profit accounting, the Statement of Financial Position (SOP) gives a clear picture of the breakdown of net assets to help readers understand the overall health of the nonprofit organization. Donors want assurance their contributions are being used as intended and leaders need to know what resources are actually available for day-to-day expenses. It is important to classify net assets correctly because misclassification can lead to audit findings, restatements, or can even jeopardize the organization’s compliance.

If an organization’s cash is less than its restricted assets, the nonprofit may not have enough spendable cash to cover operating expenses (payroll, rent, vendors). A non-profit entity with little cash and cash equivalents and significant restricted assets is not a healthy organization.

In addition, because restricted funds must be used for their intended purpose, if cash is insufficient to honor those restrictions, the nonprofit risks violating donor intent, having to return grant funds, or facing reputational or legal consequences.

As part of the annual audit process, auditors will validate asset classifications to ensure the organization has properly recorded all restricted contributions. Auditors will also review all releases from restrictions to ensure the organization is spending funds appropriately. Their goal is to confirm that restricted vs unrestricted funds are fairly stated, legally compliant, and transparent to readers of the financial statements.

Our team at ARI has decades of experience working with nonprofit organizations helping them, among other things, classify assets appropriately to ensure transparency.