Demystifying Asset Classifications for Non-Profit Organizations

Many of our non-profit clients and their Board members often express confusion about the requirements for classifying net assets.

The net assets for a non-profit organization are similar to retained earnings for a for-profit company – they represent the cumulative earnings of the company from inception to date. The major difference is that, in a non-profit entity, the net assets are split into three categories, which are described below. Like a for-profit, net asset classifications appear in the equity section of the Statement of Financial Position (SOP).

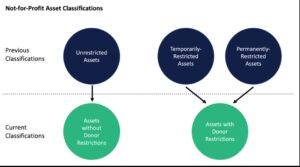

Until recently non-profit organizations classified net assets into three categories:

In 2018, the Financial Accounting Standards Board (FASB) replaced these three net asset classifications with the following two:

It is important to note that many non-profit organizations continue to use three net asset classifications in their internal financial statements. The current two classifications shown above are used for GAAP (Generally Accepted Accounting Principles).

Similar to the Balance Sheet in the for-profit world, the SOP gives readers, including members of the Board of Directors and Finance Board, a clear picture of the breakdown of net assets to help them understand the overall health of the organization.

For a quick health check, readers should compare the organization’s cash and cash equivalents (cash, receivables and investments) to the amount of restricted net assets, both temporary and permanent. If the total cash is less than the restricted assets, the entity is considered to be “under water.” A non-profit entity with little cash and cash equivalents and a lot of restricted assets is never a good thing.

In addition, as part of the annual audit process, auditors will validate asset classifications to ensure the organization has properly recorded all restricted contributions. They will also review all releases from restrictions to ensure the organization is spending funds appropriately.

If you are considering outsourcing your organization’s accounting requirements, you’ve come to the right firm. We have decades of experience in the non-profit accounting space and have worked with scores of organizations.

Discover the 10 Benefits of Outsourcing Your Accounting Function and contact us to discuss your needs and determine if we are the right fit for you.

In the meantime, check out a list of all accounting tasks we manage so you can focus more time on your non-profit’s core mission.